Average Rents and Gross Rental Yield

What do Average Rents and Gross Rental Yield tell us?

Average Rents

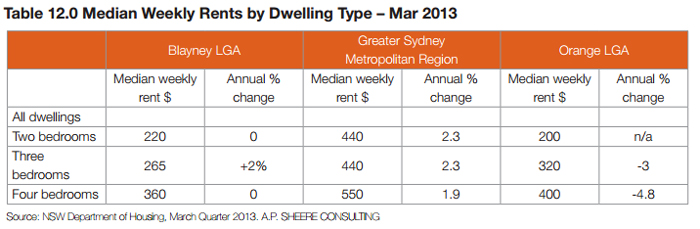

Changes in Median Weekly Rents give an indication of how the local rental market is performing in terms of investment opportunities. Rising rents can result in greater returns for investors as people compete for limited stock whilst decreasing rents can indicate a slow down in the rental market and perhaps an over-supply of rental properties.

Gross Rental Yield

Yield is a measure of the percentage of income return you get from an asset. This measure applies to a number of assets, but especially shares and real estate. For real estate, the yield calculation is the percentage of rental income for the purchase price. The yield is calculated by dividing the gross annual rental income by the purchase price (or the current valuation).

For example, if a property is rented for $315 per week, and the purchase price is $409,000, then the yield is (315*52)/409000 = 4.01%.

What does Blayney’s Average Weekly Rents tell us?

Figures issued by the NSW Department of Housing 2012 indicate that the average median weekly rent for a three bedroom property was $260.00 in the Blayney LGA. This compares to $320.00 per week in Orange. Three bedroom dwellings was the only sector which showed an increase in median weekly rents of 2% between December 2012 and March 2013 highlighting potential opportunities for further development.

Gross Rental Yield

Indicative Gross Rental Yield according to RP Data was 4.9% for houses in Blayney (2012).

What opportunities does the rental sector present in Blayney?

The growing mining sector in the region may increase the demand for rental property and quality constructed developments for new residents. Markets that could be targeted include the family market but also single professionals (urban development) and those looking for the convenience of serviced accommodation close to, or within, Blayney’s town centre.

Last modified:

30 Sep 2014