FAQs

Back to SRV Info Page

Why do we need to increase rates?

Council in its 2023-24 to 2026-27 Delivery Program and 2023-24 Operational Plan, identified its ongoing challenge of costs growing faster than revenue. Unfortunately, it is not possible for Council to 'do nothing' as Council’s forecast revenue is consistently less than its expenses over the 10-year Long Term Financial Plan (LTFP).

Council needs to address the forecast deficits in the financial outlook for the General Fund. This is critically important because the General Fund contains provision for all Council services apart from sewerage and waste services.

The amount of funding available in General Fund directly supports the maintenance of critical assets, services and community facilities, including: roads, bridges, culverts, parks, footpaths and buildings.

Council is not able to cover the increasing costs by the annual ‘rate peg’ which is set by the NSW Independent Pricing and Regulatory Tribunal (IPART).

Back to FAQ list Back to SRV Info Page

What is the Rate Peg?

Each year, IPART set a maximum percentage increase by which a council can raise its overall rate income; this is known as the rate peg. The Local Government Act does not allow councils to increase its total yield from rate income by more than the rate peg without a special approval, known as a Special Variation, or more commonly known as a Special Rate Variation (SRV).

IPART guides all NSW councils to assume a 2.5% rate peg. The rate peg system is broken as it does not keep pace with increasing costs caused by many factors including inflation and does not meet the costs of new infrastructure or extra services.

It is noted, in late 2022, inflation reached 7.8%, and the rate peg set by IPART for Councils was 3.7%.

The rate peg only applies to the general rate income and does not apply to other annual charges or fees that Council collects, including waste and sewer charges.

Back to FAQ list Back to SRV Info Page

How will the proposed Special Rate Variation impact my rates?

The rate rise would not apply to the total of your rates notice.

The rate rise would apply to the rate charge on your notice that pays for general Council services, including; general services, roads, bridges, culverts, footpaths, parks, sports grounds, library, CentrePoint and showgrounds.

Specifically, the special variation does not apply to; garbage collection, general waste, or sewerage which are reviewed and determined annually by Council.

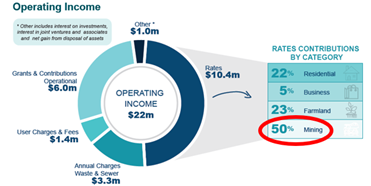

Note: As the mining category contributes a high proportion of rate income generated by Council (approximately 50%), it must be highlighted that if the Cadia Gold mine operations change or the proposed McPhillamy’s Gold mine does not commence as assumed in Council's financial planning, Council will need to have future engagement regarding an additional SRV. Read more below about the mining impact.

Click here to see the average increase per rate category (not including waste or sewer charges).

Back to FAQ list Back to SRV Info Page

What do we get in return for an increase in rates?

The SRV will enable an average annual investment of $7 million per annum in the asset renewal program. This will ensure we have financial capacity to maintain the standard of our assets, services and community facilities, including: roads, bridges, culverts, parks, footpaths and buildings.

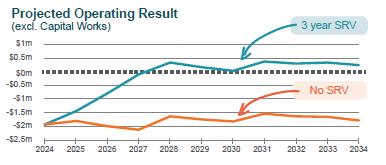

Council is not seeking an instant quick fix. Even with the proposed 3-year SRV a positive operating result is not forecast until 2028. The longer we leave it and take no action, the larger and more severe a future SRV will have to be.

Council is seeking to be proactive in addressing this very important issue as early as possible and over 3 years, rather than a large singular increase.

The above table shows that the SRV will move Council’s Operating Results from annual deficits to a financially sustainable position in the long term. This will assist Council’s investment to maintain the standard of community facilities and assets.

Back to FAQ list Back to SRV Info Page

What is the alternative to the proposed rate increase?

Without an SRV, Council would have to; significantly reduce expenditure on roads, bridges and culverts and more widely significantly reduce all services and increase fees and charges to hirers (mainly community and user groups).

We would also have to rely solely on grant funding to maintain and upgrade assets (roads, bridges and culverts in particular) and consequently community infrastructure will deteriorate if our own funding is not available.

Council is seeking to be proactive in addressing this very important issue as early as possible and over 3 years, rather than a large singular increase.

Back to FAQ list Back to SRV Info Page

If my land value goes up, doesn’t that mean I will pay even more in rates?

No. The important thing to know about land values, in the General Land Valuation process, and their effect on your rates is how land value changes are relative to other land values in the same rate category. Council’s total yield from rates does not change however amounts payable by individual ratepayers, in their respective rate category, vary based on changes within that category. Council’s total yield from rates does not change however amounts payable by individual ratepayers, in their respective rate category, vary based on changes within that category.

Back to FAQ list Back to SRV Info Page

What happens when the rate variation finishes?

The proposed SRV will be permanent and after 3 years, rates will increase therefore by the annual rate peg amount set by the Independent Pricing and Regulatory Tribunal (IPART).

Note: As the mining category contributes such a high proportion of rate income (50%) generated by Council, it must be highlighted that if the Cadia Gold mine operations change or the McPhillamys Gold mine does not commence as assumed, Council will need to have future engagement regarding an additional SRV. Read more below about the mining impact.

What support is there for people who can’t afford to pay their rates?

In assessing Council’s application, IPART will independently consider the ability of ratepayers to pay their rates.

Council has a Financial Hardship policy designed to support ratepayers in situations beyond their control and defer payments where they would cause hardship. We offer interest-free payment arrangements for up to two years, and all applications are assessed against eligibility conditions in our policy.

You can learn more about this policy and find our hardship application at https://www.blayney.nsw.gov.au/your-place/rates-and-payments/difficulty-paying-your-rates

Council also engages with a specialist in early-stage debt management who helps ratepayers to avoid unmanageable debt through understanding ratepayer situations and to share respectful, compassionate, rational help. This process also assesses individual financial situations, counsels and helps make payment plans early in the debt cycle to help mitigate risk of significant financial stress.

What other Councils have applied to IPART for an SRV?

Many councils are facing similar challenging financial issues.

In 2022/23 IPART assessed 17 special variation applications. To find the full list and amounts, click here.

IPART have advised Council approximately 20 Councils have indicated they will apply for a special variation to commence on 1 July 2024.

In May 2023, the NSW Country Mayors Association undertook an annual survey and 79% of Councils indicated, they have either undertaken an SRV in the past 2 years or will need to in the next 5 years.

You can also compare our rates to other Councils here.

Back to FAQ list Back to SRV Info Page

What has Council done to address its financial situation?

Over the last 18 months Council has had 2 specialist independent consultants review Council’s financial position.

Council additionally regularly reviews its operations and actively identifies and implements initiatives to ensure that it is seeking to contain costs and finds efficiency gains so that it can provide value for money to the community.

Council has already found and implemented ongoing savings of $690,000 per year in financial benefits to Council, a one-off benefit of $1 million and a cashflow benefit of some $4 million in grant-funded asset renewal projects not requiring Council funds, in addition to extensive additional efficiency and productivity gains and improvements in operational sustainability.

Before considering a Special Rate Variation, Council sought to identify further savings and cost containment opportunities.

As part of the review, Council’s senior management team identified, costed and prioritised 26 present improvements, which Council will be implementing over the next three to four financial years (with some having a slightly longer implementation timeframe).

These will be included within Council’s revised LTFP and any SRV application. The present improvements include cost savings, efficiency gains, revenue increases and key items that are necessary for long-term operational sustainability.

There are an additional 13 improvements that have been identified as opportunities that need to be investigated in the LTFP.

Further details on these improvement initiatives and organisational sustainability requirements can be found in the Council’s Organisational Sustainability Improvement Plan on the SRV Page.

Back to FAQ list Back to SRV Info Page

What other financial implications has Council had to address?

In addition to the material supply shortages, increases in construction costs, increases in energy costs and rising inflation, Council has been significantly impacted by mandated financial implications and cost-shifting from the NSW Government.

Cost shifting is one of the most significant problems faced by all councils in NSW. Along with rate pegging, cost shifting undermines the financial sustainability of the local government sector.

What is Cost Shifting? Cost shifting describes a situation where the responsibility for the cost of, providing a certain service, concession, asset, or regulatory function is "shifted" from one sphere of government to another sphere of government without the provision of corresponding funding or the conferral of corresponding and adequate revenue-raising capacity.

Two examples of Cost Shifting are;

Rural Fire Service Assets: In 2022/23, RFS fleet assets (vehicles, known as Red Fleet, and RFS buildings) were recognised as “property” of Council, by virtue of the Rural Fire Services Act, and recorded in Council’s financial statements with Council required to therefore absorb all depreciation costs that is reported against Council’s financial performance.

This follows a long-standing dispute over the accounting treatment of the RFS assets that came to a head with the Auditor-General's 2021 Report on Local Government on 22 June 2022. With Council having to account for RFS assets, this adds approximately $265k in depreciation to Council’s budget for 2023/24.

Emergency Services Levy (ESL): The ESL is a cost imposed on councils and the insurance industry to fund the emergency services budget in NSW. The majority is paid as part of insurance premiums, with a further 11.7% picked up by councils and 14.6% was paid by the State Government itself.

Councils Emergency Services Levy contribution for 2023/24 is $484k (an increase of 36%) towards the cost of; RFS, SES and NSW Fire & Rescue. The 2023/24 contribution increase is compounded with the NSW Government advising in May 2023 it will no longer provide a subsidy for the Emergency Services Levy. Removal of the subsidy had an instant negative impact of $128k to Councils 2023/24 budget.

Back to FAQ list Back to SRV Info Page

What grant funding has Council applied for or received recently?

Council in recent years has been very proactive in obtaining many state and federal government grants.

Grant funding must be used for the specific purpose as outlined in the grant guidelines and funding deed. Grant funding is generally restricted from being used for operational purposes and normally required to be expended for a capital purpose such as; road upgrades, bridge replacements, footpaths, and improvements to CentrePoint, King George Oval, toilet blocks and the showground.

Our Capital Expenditure budget for 2023/24 is funded with 70% of income from government grants.

Obtaining further grant funding is not a solution to creating a positive operating result in Council's General Fund.

Resources for Regions Grant Program

Over the past 4 years, Council has particularly benefited ($21.4m) from the NSW Government Grant Program called ‘Resources for Regions’.

Resources for Regions returned a very small amount (2%) of mining royalties collected by the NSW Government, and directly allocated that money to funding 26 Council’s impacted by mining operations.

Disappointingly, in September 2023 the NSW Government ceased the Resources for Regions Grant funding program. This decision has directly removed $4m in annual grant funding from Blayney Shire Council.

Find out more about our current projects here and their funding sources.

Back to FAQ list Back to SRV Info Page

How are rates calculated?

Back to FAQ list Back to SRV Info Page

What does mining contribute?

The mining rate category (Cadia Valley Operations) currently comprise 50% of Council’s annual rating income.

Cadia will therefore directly bear 50% of the SRV (approximately $500k per annum).

With our reliance on mining it does create long term risk for Council and community.

IPART have advised Council to forecast in the updated LTFP that the McPhillamys Gold Project will likely commence and additional rate income will eventuate given the mine recently obtained planning approval. Council has made a conservative assumption in this regard.

As the mining category contributes such a significant amount of rate income, it must be highlighted if the Cadia Gold mine operations change or the McPhillamys Gold mine does not commence as assumed in the LTFP, Council will need to have future engagement regarding an additional SRV.

Back to FAQ list Back to SRV Info Page

Where are we up to in the process?

Over the last 18 months Council has had 2 specialist independent consultants to review Council’s financial position.

Following these external reviews, Council has implemented various improvements and identified additional efficiencies to review and consider in the future. Both consultants recommended Council proceed to undertake a Special Rate Variation.

Council is conducting Community Engagement over November – December 2023 on the proposed increase which includes a number of community information sessions and drop in times. Residents can also put in a submission about the proposal during this period.

Following the Community Engagement, Council will meet on the 23 January 2024 to resolve whether to proceed with the application to IPART.

Applications for an SRV must be lodged with IPART by 5 February 2024.

IPART then proceed to assess the application including their own community consultation over February and March 2024. See: https://www.ipart.nsw.gov.au/Home/Industries/Local-Government/Special-Variations

Any increase would not commence until 1 July 2024.

Back to FAQ list Back to SRV Info Page

How has Council kept the community informed of a potential rate increase?

The need for a potential rate increase was highlighted as part of the 2023/24 budgeting and planning process for this current financial year.

The annual rates newsletter distributed in July 2023 to all rate payers included information that Council was commencing the Special Rate Variation process and explained that Council would be looking to engage with the community on the matter. This newsletter was distributed to all rate payers, posted on social media, published in the Blayney Chronicle and distributed to our email mailing list.

Under the Integrated Planning and Reporting (IP&R) requirements of the Local Government Act 1993. Council endorses a draft ‘Delivery Program and Operational Plan (DP/OP) each year, then publicly exhibits the draft DPOP over May and subsequently adopts a final DPOP in June. Councils DPOP for 2023/24 was adopted in June and highlighted the need to address financial sustainability including and consider an SRV.

On 9 November 2023 Council resolved to proceed to undertake Community Engagement from 10 November to 15 December 2023 on the proposed SRV.

A number of drop-in sessions will be held across the Shire allowing residents to ask questions and provide feedback on the proposal.

Back to FAQ list Back to SRV Info Page

Didn't Council report a $1 million operating surplus in 2022/23? Doesn't Council currently have over $29 million in the bank?

2022/23 Surplus

Blayney Shire Council reported a $1.16m surplus however this was skewed with a 95% advance payment of the 2023/24 Financial Assistance Grant (an annual federal government operating grant) of $3.46m in late June 2023.

In real terms, had this grant not been advanced, a surplus of $59k would have been reported. Additionally, there is a risk the federal government may cease advance payments of this grant leaving a $3.5m shortfall in that particular year.

Cash restrictions

As at 30 June Council has approximately $29m in cash & investments, which is largely held in specific reserves and invested to earn interest.

Although Council currently has money in reserves, the majority of the funds are restricted for a specific purpose (including some controlled by legislation), which means they cannot be used for operational purposes.

These funds are held as restricted until they are required for their specific purpose, however Council is able to invest these funds in short term investments generating interest that comes back into Council’s unrestricted cash (except for waste and sewer which must remain in their respective funds).

Council’s main cash restrictions and purpose include;

- Sewer Services: $6.44m

- For future upgrade of the Blayney Sewerage Treatment plant scheduled for 2027/28

- Employee Leave Entitlements: $1.07m

- For payment of employee leave entitlements accrued

- Plant and Vehicle Replacements: $1.7m

- For the purchase of plant and vehicles for Council operations. Inflated due to the long lead time for the replacement of critical plant.

- Domestic Waste Management: $667k

- For the capping and operation of the Blayney Waste Facility.

- Quarry Reserve: $219k

- For the remediation of Council operated quarries.

- Election Reserve: $71k

- To be used to fund the 2024 Local Government Election costs

- IT Reserve: $360k

- To help fund future large I.T expenditure such as the upgrade of Council’s Corporate Management system.

- Property Account: $1.5m

- Comprises monies generated from previous Council property sales.

- For strategic property purchases and/or other matters as resolved by Council.

- Property Account – borrowings: $880k

- Money set aside from the sale proceeds to pay back a 10-year low interest loan taken out to develop the Streatfeild Close Blayney subdivision.

- Developer Contributions (General): $1.52m

- Contributions by developers made upfront when an additional dwelling/s or new housing lot is created.

- To be used towards funding specific and identified projects in the Blayney Shire Infrastructure Contributions Plan.

- Developer Contributions (Sewer): $1.63m

- Contributions by developers made upfront when an additional dwelling/s or new housing lot is created.

- To be used towards future upgrades of the Blayney Sewerage Treatment plant scheduled for 2027/28

- Voluntary Planning Agreements: $524k

- Council has planning agreements with both Cadia Gold Mine and Flyers Creek Wind Farm who both make an annual contribution to Council.

- Funds are used for the purposes identified in the specific planning agreements.

- Unexpended Grants: $8.21m

- Council has received grant funding in advance for specific projects which are programmed to be undertaken over the next 2 years. These projects include;

Resources for Regions Round 9 $5,984,135

- Belubula Way Bridge

- Hobbys Yards Rd

- Richards Lane

- Browns Creek Rd

- Tallwood Rd

- Barry Rd

- Blayney Main St Masterplan

- Millthorpe Main St Masterplan

- CWELC Masterplan

Resources for Regions Round 8 $323,964

- Heritage Park Amenities

- Carrington Park Amenities

- King George Oval Parking

- Trunkey St - Showground Footpath Newbridge

Stronger Country Communities Round 5 $583,820

- Victoria St & Montgomery St Millthorpe FP

- Plumb St/Palmer St - Piggott Pl - Orange Rd FP

- Orange Rd - Binstead St to Palmer St FP

- KGO Grandstand

Local Roads & Community Infrastructure $512,794

- Stormwater - Unwin & Stabback St Millthorpe

Regional & Local Roads Repair Program $236,880

- Garland Road

Fixing Country Roads $192,484

- Neville Rd Heavy Patching

Fixing Country Bridges $507,813

- Swallow Creek Bridge

NSW Flood Recovery Grant $699,714

- Richards Lane Culvert

- Newbridge Rd Culvert

- Flood Resilience Studies

Other $94,846

Back to FAQ list Back to SRV Info Page

Last modified:

27 Nov 2023